Break Even Point Straddle . Understanding the concept of breakeven point in straddle trades. Let’s take a detailed look. Call option and put option. — the breakeven point for the call leg of the straddle can be calculated using the following formula: — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. For example, if a straddle is. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction.

from wuzuccet.heroinewarrior.com

Understanding the concept of breakeven point in straddle trades. For example, if a straddle is. — the breakeven point for the call leg of the straddle can be calculated using the following formula: — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Let’s take a detailed look. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Call option and put option.

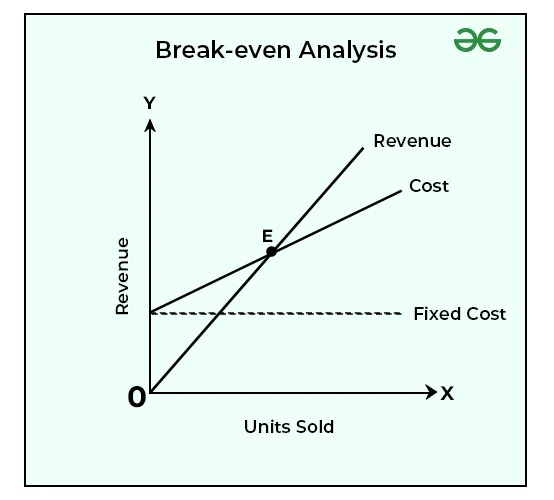

Breakeven Analysis

Break Even Point Straddle For example, if a straddle is. Let’s take a detailed look. Understanding the concept of breakeven point in straddle trades. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. — the breakeven point for the call leg of the straddle can be calculated using the following formula: For example, if a straddle is. — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Call option and put option.

From oer.pressbooks.pub

Calculate the breakeven point Accounting and Accountability Break Even Point Straddle Let’s take a detailed look. For example, if a straddle is. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Call option and put option. Understanding the concept of breakeven point in straddle trades. — the breakeven point for the call leg of. Break Even Point Straddle.

From www.marketing91.com

Breakeven Point Meaning, Advantages, Disadvantages and Examples Break Even Point Straddle For example, if a straddle is. — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Let’s take a detailed look. Understanding the concept of breakeven point in straddle trades. — the breakeven point for the call leg of the straddle can be calculated. Break Even Point Straddle.

From wuzuccet.heroinewarrior.com

Breakeven Analysis Break Even Point Straddle — the breakeven point for the call leg of the straddle can be calculated using the following formula: — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Let’s take a detailed look. For example, if a straddle is. — in order for. Break Even Point Straddle.

From www.tutor2u.net

Breakeven Point (GCSE) tutor2u Business Break Even Point Straddle Call option and put option. — the breakeven point for the call leg of the straddle can be calculated using the following formula: — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Let’s take a detailed look. Understanding the concept of breakeven point. Break Even Point Straddle.

From www.101computing.net

Break Even Point 101 Computing Break Even Point Straddle — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. — the breakeven point for the call leg of the straddle can be calculated using the following formula: Call option and put option. For example, if a straddle is. Let’s take a detailed look.. Break Even Point Straddle.

From strategiccfo.com

Breakeven Analysis Breakeven Analysis in Pricing • The Strategic CFO Break Even Point Straddle Let’s take a detailed look. Understanding the concept of breakeven point in straddle trades. For example, if a straddle is. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Call option and put option. — in order for this trade to break even. Break Even Point Straddle.

From simplypayme.com

What is BreakEven Point & How it Can Lead to Success SimplyPayMe Break Even Point Straddle — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Understanding the concept of breakeven point in straddle trades. Let’s take a detailed look. For example, if a straddle is. — a long straddle is an advanced options strategy used when a trader is. Break Even Point Straddle.

From ellengrofranco.blogspot.com

A Break Even Analysis Graph Contains Which of the Following Break Even Point Straddle — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. For example, if a straddle is. Understanding the concept of. Break Even Point Straddle.

From www.macroption.com

Short Straddle Payoff and BreakEven Points Macroption Break Even Point Straddle — the breakeven point for the call leg of the straddle can be calculated using the following formula: Let’s take a detailed look. Understanding the concept of breakeven point in straddle trades. — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Call option. Break Even Point Straddle.

From infohub.delltechnologies.com

The Public Cloud breakeven point Choosing Between OnPremises vs the Break Even Point Straddle — the breakeven point for the call leg of the straddle can be calculated using the following formula: Understanding the concept of breakeven point in straddle trades. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Call option and put option. —. Break Even Point Straddle.

From www.ecommerceceo.com

How To Use A Break Even Point Calculator For Business Profitability Break Even Point Straddle — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Call option and put option. For example, if a straddle is. — the breakeven point for the call leg of the straddle can be calculated using the following formula: Understanding the concept of breakeven. Break Even Point Straddle.

From www.freepik.com

Free Vector Break even point graph Break Even Point Straddle — the breakeven point for the call leg of the straddle can be calculated using the following formula: Understanding the concept of breakeven point in straddle trades. — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. Call option and put option. Let’s take. Break Even Point Straddle.

From cfoperspective.com

How to Move from Complexity to Clarity with a BreakEven Analysis Break Even Point Straddle Call option and put option. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. For example, if a straddle is. — the breakeven point for the call leg of the straddle can be calculated using the following formula: Let’s take a detailed look.. Break Even Point Straddle.

From optionalpha.com

Long Straddle Option Strategy Guide Break Even Point Straddle — the breakeven point for the call leg of the straddle can be calculated using the following formula: For example, if a straddle is. Call option and put option. Let’s take a detailed look. Understanding the concept of breakeven point in straddle trades. — a long straddle is an advanced options strategy used when a trader is seeking. Break Even Point Straddle.

From www.geeksforgeeks.org

Breakeven Analysis Importance, Uses, Components and Calculation Break Even Point Straddle For example, if a straddle is. Let’s take a detailed look. Call option and put option. — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. — a long straddle is an advanced options strategy used when a trader is seeking to profit from. Break Even Point Straddle.

From ellengrofranco.blogspot.com

A Break Even Analysis Graph Contains Which of the Following Break Even Point Straddle Let’s take a detailed look. — in order for this trade to break even at expiration, the stock must be above $54 a share or below $46 a share. — the breakeven point for the call leg of the straddle can be calculated using the following formula: For example, if a straddle is. Call option and put option.. Break Even Point Straddle.

From www.investopedia.com

What Is a Straddle Options Strategy and How Is It Created? Break Even Point Straddle — the breakeven point for the call leg of the straddle can be calculated using the following formula: Let’s take a detailed look. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. — in order for this trade to break even at. Break Even Point Straddle.

From financialexamhelp123.com

Straddle Financial Exam Help 123 Break Even Point Straddle Let’s take a detailed look. — a long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction. Understanding the concept of breakeven point in straddle trades. — the breakeven point for the call leg of the straddle can be calculated using the following formula: For example,. Break Even Point Straddle.